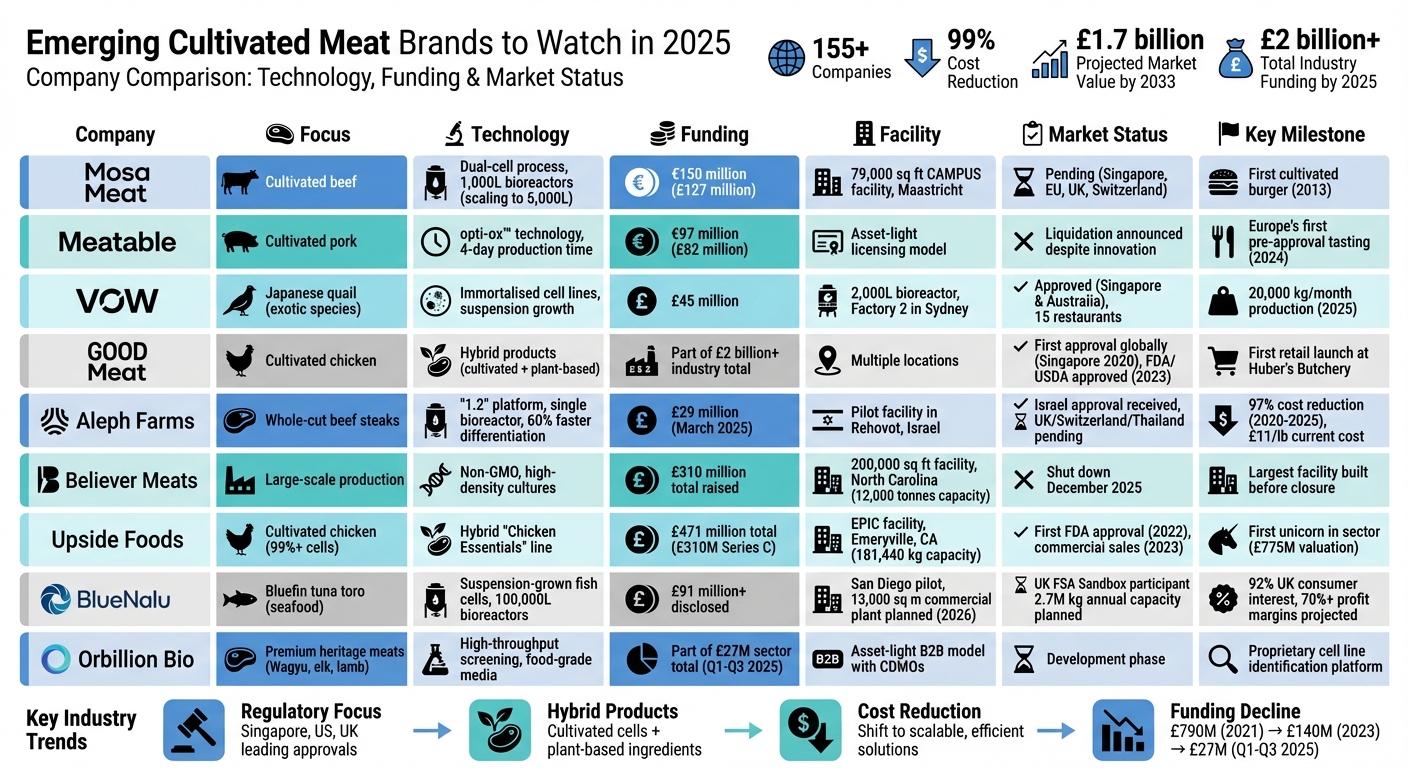

The cultivated meat industry is rapidly evolving from a niche concept to a viable market. By 2025, over 155 companies were producing meat from animal cells, with production costs dropping by 99% since 2013. This shift is driven by significant investments, regulatory progress, and advancements in production methods. Key players include Mosa Meat, Meatable, Vow, GOOD Meat, Aleph Farms, and others, each focusing on scaling operations, achieving cost parity, and securing regulatory approvals. The global cultivated meat market is projected to reach £1.7 billion by 2033, signalling a major transformation in how meat is produced and consumed.

Top 9 Cultivated Meat Companies: Technology, Funding, and Market Status 2025

The future of meat? Inside the Oxford-based startup turning cells into 'steaks'

Quick Overview:

- Mosa Meat: Focuses on cultivated beef with advanced dual-cell processes and renewable energy-powered facilities.

- Meatable: Uses opti-ox™ technology for efficient pork production; faced liquidation despite innovation.

- Vow: Targets luxury dining with exotic species like Japanese quail.

- GOOD Meat: First to gain regulatory approval in Singapore; expanding in the US.

- Aleph Farms: Concentrates on whole-cut beef steaks with streamlined production methods.

- Believer Meats: Shut down in late 2025 due to financial challenges despite large-scale ambitions.

- Upside Foods: Produces cultivated chicken and hybrid products; leading US market approvals.

- BlueNalu: Specialises in cultivated bluefin tuna toro; plans large-scale seafood production.

- Orbillion Bio: Focuses on premium heritage meats like Wagyu beef and elk.

Key Trends:

- Focus on regulatory approvals in markets like Singapore, the US, and the UK.

- Investments shifting towards companies with scalable, cost-effective solutions.

- Hybrid products (cultivated cells + plant-based ingredients) gaining traction.

- Public support reflected through crowdfunding and consumer surveys.

The cultivated meat industry is poised for growth, but challenges like funding constraints and regulatory hurdles remain. Companies that prioritise cost reduction, market readiness, and consumer education are likely to lead the next phase of this food revolution.

1. Mosa Meat

Pioneering Cultivated Meat Technology

Mosa Meat, the company behind the first-ever cultivated beef burger introduced in 2013, has developed a sophisticated dual-cell process to produce cultivated meat. This process involves growing muscle and fat separately using bovine satellite cells and fibro-adipogenic progenitors. Fat cells are matured within three-dimensional edible hydrogels, ensuring the final product delivers the authentic taste of beef [5].

The company operates a 79,000 sq ft facility known as "CAMPUS" (Centre for Advanced Meat Production, Upscaling, and Sustainability) in Maastricht. This includes a 30,000 sq ft scale-up facility powered entirely by renewable energy, reflecting their commitment to sustainable production [4][6].

This technological progress has not only improved the quality of their products but also boosted investor confidence, paving the way for scaling operations.

Funding and Investment Support

Mosa Meat's forward-thinking approach has drawn significant financial backing, enabling the company to expand its operations.

To date, the company has secured around €150 million (£127 million) in funding. This includes a €40 million (£34 million) oversubscribed funding round in April 2024 and a successful crowdfunding campaign in February 2025, both of which have supported the growth of its Maastricht facility [4][5][6].

Its diverse group of investors includes state-backed impact organisations like Invest-NL, traditional meat producers such as PHW Group and Nutreco, and prominent individuals like Leonardo DiCaprio and Google co-founder Sergey Brin [4][5][6].

Scaling Up and Market Preparedness

Mosa Meat is currently producing cultivated burgers in 1,000-litre bioreactors and has plans to transition to larger 5,000-litre vessels. Formal tastings conducted in the Netherlands under government-approved conditions have demonstrated significant progress toward achieving cost-effective, large-scale production [4][5][6].

"Today, through fundamental scientific breakthroughs and scaling efficiencies, we are producing burgers at a price point ready for restaurant menus",

said CEO Maarten Bosch [5].

Regulatory Pathways and Global Focus

Mosa Meat has submitted regulatory dossiers in multiple regions, including Singapore, the EU, the UK, and Switzerland, with Singapore expected to be the first market for its products. The company is also participating in the UK Food Standards Agency's £1.6 million sandbox programme. This initiative involves more than 70 scientists conducting a two-year safety study, accelerating the regulatory process [3][5][6].

"We are honoured to be one of the few included in this government-funded collaborative programme... These are exactly the kind of public-private partnerships we envisioned when we debuted the world's first cultivated burger right here in London in 2013",

remarked Dr. Mark Post [3].

2. Meatable

Advancing Cultivated Meat with opti-ox™ Technology

Meatable has embraced its patented opti-ox™ technology, a system designed for highly efficient meat cultivation. This unique approach grows real muscle and fat cells from pluripotent stem cells, setting it apart from other companies that rely on myosatellite cells. Unlike traditional methods, which often require scaffolds and multiple bioreactor stages, Meatable's process simplifies production significantly [1][8].

In May 2023, the company achieved a major milestone by cutting its production time in half, reducing it to just four days - a pace far ahead of the industry norm [1][9]. This technology is versatile, capable of replicating cells from various species such as cows, sheep, and fish. However, Meatable has primarily concentrated on pork products [1].

Strong Financial Backing and Strategic Investments

Meatable has raised an impressive €97 million (£82 million) in funding [1]. In November 2025, the company partnered with Desmos Capital Partners, an investment bank founded by former UK Energy Minister Chris Skidmore, to secure an additional €30 million (£25 million) in capital [8].

Chris Skidmore, Chair and Founding Partner at Desmos Capital Partners, commented:

"Meatable's innovation is exactly the kind of transformative product that Desmos was established to help grow and establish across new sustainable markets where there is strong demand" [8].

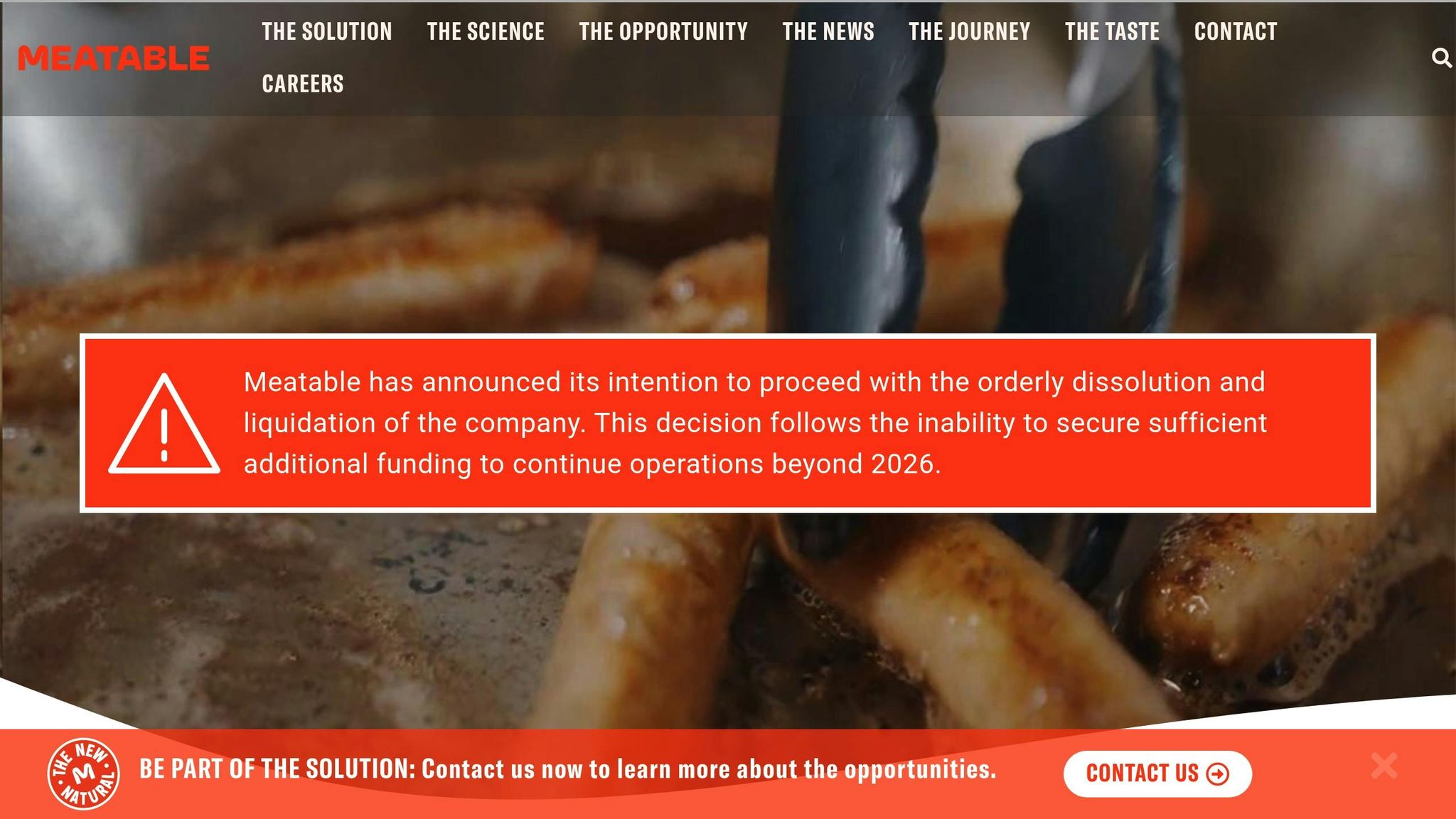

Despite this solid financial support, Meatable later faced funding challenges and announced plans for an orderly liquidation.

Market Strategy and Early Product Testing

Rather than investing in full-scale production facilities, Meatable adopted an asset-light licensing model, partnering with established meat producers to bring their products to market efficiently. CEO Jeff Tripician highlighted this approach, saying:

"We focus on an asset-light licensing model - partnering with traditional meat producers - for maximum impact" [8].

In early 2024, Meatable hosted Europe's first official pre-approval tasting of cultivated meat in the Netherlands. Attendees sampled sausages made with 28% cultivated pork fat, blended with plant-based ingredients [1][8]. Chef Jose Luis del Amo from Classic Fine Foods shared his enthusiasm, stating:

"I'm craving for more" [7].

Regulatory Progress and Global Ambitions

Meatable's focus on regulatory compliance and innovation earned it a spot in the UK Food Standards Agency's £1.6 million "sandbox" programme in March 2025. This initiative, which included just eight international companies, allowed Meatable to work closely with UK regulators to demonstrate product safety and streamline the approval process [3].

The company had set its sights on launching cultivated pork products in Singapore by 2026, drawn to the country's supportive regulatory framework [8][9]. Meatable's efforts also garnered recognition, with its technology being named one of TIME's Best Inventions of 2024 and earning a place on Europe's 2025 Tech Tour Growth50 List [7][8].

3. Vow

Advancing Cultivated Meat Technology

Vow has carved out a unique position in the cultivated meat industry by focusing on exotic species and aiming for the high-end dining market.

Operating out of Sydney, Vow specialises in producing cultivated meat from Japanese quail under its Forged brand, specifically targeting luxury dining experiences. The company employs spontaneously immortalised cell lines that grow in suspension, eliminating the need for costly scaffolds, multiple bioreactors, excessive growth factors, and albumin. This streamlined approach significantly cuts production expenses [10].

George Peppou, Vow's CEO and Co-founder, shared his vision for this strategy:

"I've always said that my goal is to make unparalleled, distinctive premium novel foods and experiences... not to perfectly replicate every element of animal tissue." [10]

Investment and Financial Strategy

Vow has raised around £45 million from investors like Blackbird and Prosperity7 Ventures. This funding has supported the development of a pilot plant equipped with a 2,000-litre bioreactor and the construction of its larger Factory 2 facility. Rather than aiming for mass-market production, Vow's financial model centres on luxury products with premium pricing. As Peppou explained:

"If we can build a luxury business and use at least some of that cash flow to subsidise the cost of building a nutrition driven business, I think that's a much better way to come down market." [10]

Commercial Launch and Scaling Up

Vow became the third company worldwide to bring cultivated meat to market, debuting its Forged Parfait at Singapore's Mandala Club in April 2024. By mid-2025, production had expanded from 1,500 kg to 20,000 kg per month. With products available in 15 Singaporean restaurants, Vow also entered the Australian market in June 2025 [10][12].

Regulatory Approvals and Global Expansion

In April 2024, Vow received regulatory approval in Singapore, followed by FSANZ clearance in April 2025, making it the first company to sell cultivated meat in Australia. Additionally, it joined the UK Food Standards Agency's £1.6 million sandbox programme in March 2025 to expedite safety evaluations [3][11][12].

| Market | Regulatory Status | Launch Date | Key Products |

|---|---|---|---|

| Singapore | Approved (April 2024) | April 2024 | Forged Parfait, Forged Foie Gras |

| Australia | Approved (April 2025) | June 2025 | Cultured Quail Parfait, Tallow |

| United Kingdom | Sandbox Participant | Pending | TBD |

| New Zealand | Approved (April 2025) | June 2025 | TBD |

4. GOOD Meat

Regulatory Approvals and Geographic Focus

GOOD Meat made history in December 2020 by becoming the first company to secure regulatory approval for Cultivated Meat in Singapore. This milestone was a game-changer for the industry, setting the stage for future advancements [14].

In 2023, the company expanded its reach by obtaining approval from both the FDA and USDA to sell cultivated chicken in the United States. This achievement granted GOOD Meat access to the largest food market in the world. With these approvals in hand, the brand has concentrated its commercial efforts on Singapore and the United States - two regions leading the way with advanced regulatory frameworks for Cultivated Meat [13][14].

Market Readiness and Scalability

After clearing regulatory hurdles, GOOD Meat wasted no time entering the retail space. In 2024, it made headlines by being the first to offer Cultivated Meat through a retail outlet, launching its products at Huber's Butchery in Singapore. This allowed consumers to purchase cultivated chicken for home cooking directly from a butchery [13].

In the United States, GOOD Meat teamed up with Chef José Andrés to serve its cultivated chicken at China Chilcano, a restaurant in Washington, D.C. This partnership marked one of the initial commercial uses of Cultivated Meat in the U.S. market. To enhance its offerings, the company uses a hybrid approach, blending its Cultivated Meat with plant-based ingredients to refine texture, improve flavour, and manage costs [14].

Funding and Investment Backing

Investment has played a critical role in GOOD Meat's journey from research to market. By 2025, the global Cultivated Meat sector had attracted over £2 billion in funding, helping to drive down production costs significantly since 2013 [14]. This financial support has been essential in enabling GOOD Meat to scale its operations and position itself for long-term growth [14].

5. Aleph Farms

Pioneering Cultivated Meat Technology

Aleph Farms has made waves in the cultivated meat industry by focusing exclusively on whole-cut beef steaks. Branded as "Aleph Cuts", these premium products are grown directly from animal cells, offering consumers a dining experience that mirrors conventional beef steaks [2][17].

What sets Aleph Farms apart is its innovative "1.2" production platform. This system combines cell proliferation and differentiation within a single stirred-tank bioreactor, cutting differentiation time by 60% and eliminating the need for complex scaffolding [2][18].

"Our optimised process is streamlined, utilising a stirred-tank bioreactor for both proliferation and differentiation, enhancing efficiency whilst preserving product quality." - Didier Toubia, Co-founder and CEO, Aleph Farms [2]

Instead of traditional scaffolding, Aleph Farms employs a proprietary plant-based matrix to improve scalability. Additionally, its partnership with BioRaptor leverages AI to refine bioprocesses and increase cell density. These advancements have driven a dramatic 97% reduction in production costs between 2020 and 2025 [2][18].

Strategic Funding and Investments

In March 2025, Aleph Farms secured £29 million in funding, with £22 million raised through a converted SAFE and £7 million from existing investors. The company is also seeking an additional £8–12 million to complete the round [2][15][19]. CEO Didier Toubia commented:

"Aleph Farms is adjusting its fundraising to reflect 2025 market conditions. That said, this adjustment presents a compelling entry point for new investors." [2]

This funding will support the expansion of Aleph Farms' pilot facility in Rehovot, Israel, and the establishment of intermediate-scale production sites in Europe and Asia. Instead of owning all infrastructure, the company is adopting an asset-light strategy by forming partnerships [2][15].

"The sustained confidence shown by existing investors is a clear indicator of Aleph Farms' strength, execution, and potential to deliver relevant, scalable solutions for humanity's most pressing challenges in a way that is profitable, capital-efficient, and responsible." - Jonathan Berger, CEO, The Kitchen Hub [2]

Aleph Farms' investor list includes major players such as private equity firm L Catterton, UAE sovereign wealth fund DisruptAD, and strategic food companies like Cargill, Thai Union, BRF, CJ CheilJedang, and Strauss Group [2][20].

Scaling Production for Market Readiness

Currently, Aleph Farms produces cultivated beef at a cost of roughly £11 per pound at the 2,000–5,000-litre scale. The company aims to reduce this to £5–6 per pound with large-scale production [2][18][19]. To achieve this, Aleph Farms is establishing mid-scale facilities in partnership with BBGI and Fermbox Bio in Thailand, as well as The Cultured Hub in Switzerland. This approach not only supports scaling but also helps mitigate geopolitical risks [2][15][16].

"The funding will be used to scale up our pilot facility and launch the first Aleph Cut through an optimised production process designed for profitability and serving as a foundation for scaling the business globally." - Didier Toubia, Co-founder and CEO, Aleph Farms [2]

Looking ahead to its next phase, Aleph Farms plans to employ a gene-edited platform to achieve the scale and cost efficiency needed for mass-market entry in the United States. These efforts position the company for global growth and regulatory milestones [2].

Regulatory Progress and Global Expansion

Aleph Farms has already achieved a significant milestone by becoming the first company to receive a "No Questions" letter from Israel's Ministry of Health for cultivated beef, paving the way for commercial sales. The company is now updating its regulatory submission to include the "1.2" production process, with a launch expected in the first half of 2026 [2][16].

Regulatory applications are also advancing in the United Kingdom, Switzerland, and Thailand, which are key markets for Aleph Farms' European and Asian expansion plans. The company has signed four new commercial agreements across Asia, Israel, and Europe to support its market entry efforts [2][15]. Meanwhile, the United States remains a focus for future mass-market adoption, with Israel serving as the central production hub and Switzerland, the UK, and Thailand acting as regional gateways [2].

sbb-itb-c323ed3

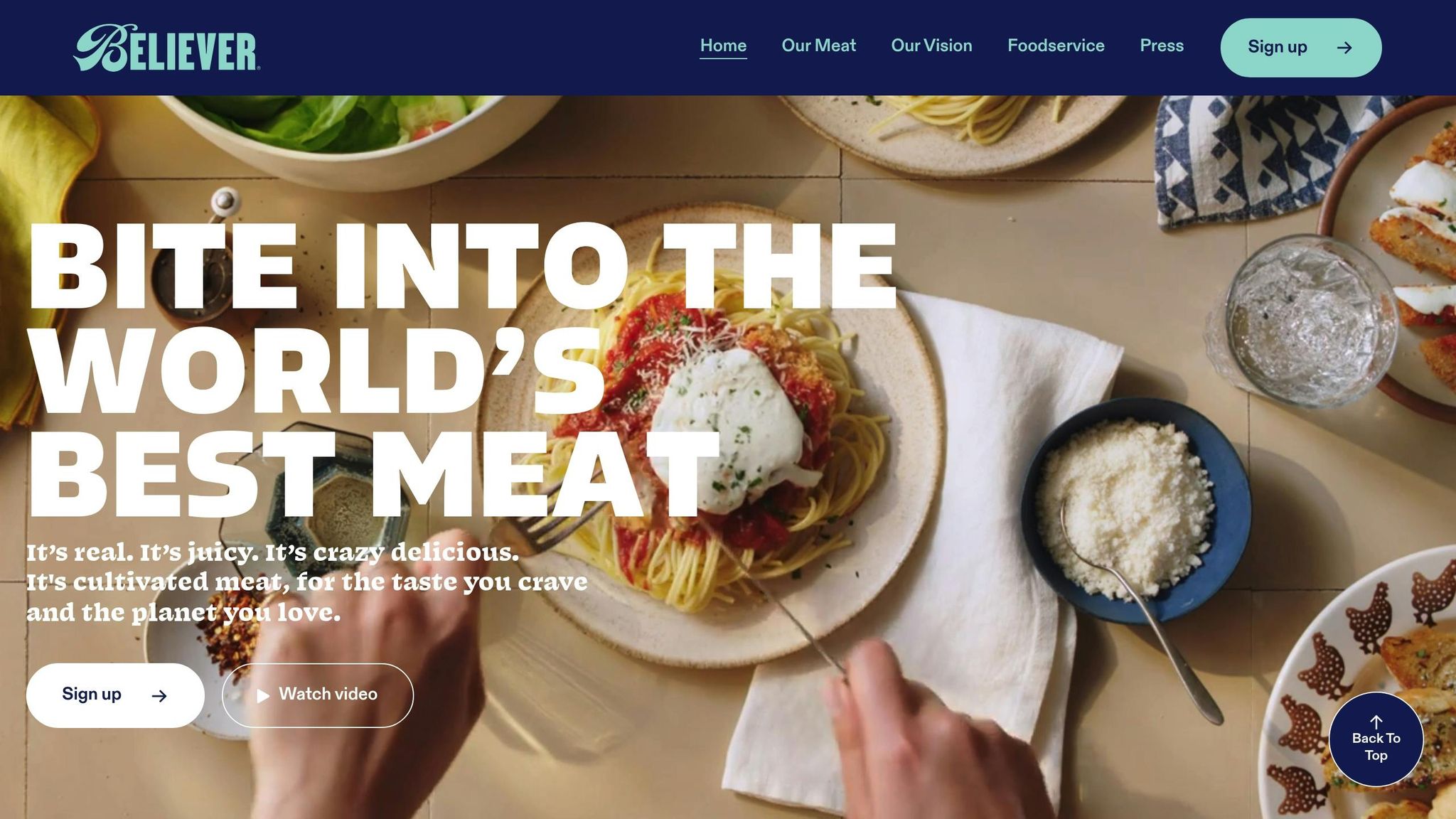

6. Believer Meats

Funding and Investment Backing

Believer Meats managed to raise over £310 million in total funding. A significant portion of this came from a £276 million Series B round in 2021, which valued the company at £477 million. This round drew interest from prominent investors like ADM Ventures, Tyson Ventures, S2G Investments, Hedosophia, Emerald Technology Ventures, and Cibus Capital [23][26].

However, by late 2025, the company found itself in financial trouble. Efforts to secure additional funding in November 2025 fell through, leaving the company in a precarious position [23][24]. The situation worsened in December 2025 when a key investor pulled out, leading to a complete shutdown of operations and widespread layoffs [24][26].

Market Readiness and Scalability

Financial challenges weren’t the only hurdles for Believer Meats; operational scalability also became a sticking point. The company had constructed a massive 200,000-square-foot facility in Wilson, North Carolina, aiming to produce up to 12,000 metric tonnes of cultivated meat annually [25][26]. Their production relied on proprietary Non-GMO technology, designed to optimise high-density cell cultures and efficient media usage [22]. Unfortunately, despite the ambitious setup, the facility was completed just before the company’s closure, and they never achieved validation at the 20,000-litre production scale [23][24].

Adding to their troubles, the design-build firm responsible for the facility filed a lawsuit against Believer Meats, claiming £27 million in unpaid construction costs and pushing for foreclosure or the sale of the facility [23][26]. By 2025, investors had started prioritising companies with proven unit economics over those pursuing high-cost, large-scale projects. The fall of Believer Meats highlights this industry shift towards businesses focused on validated technology and financial sustainability.

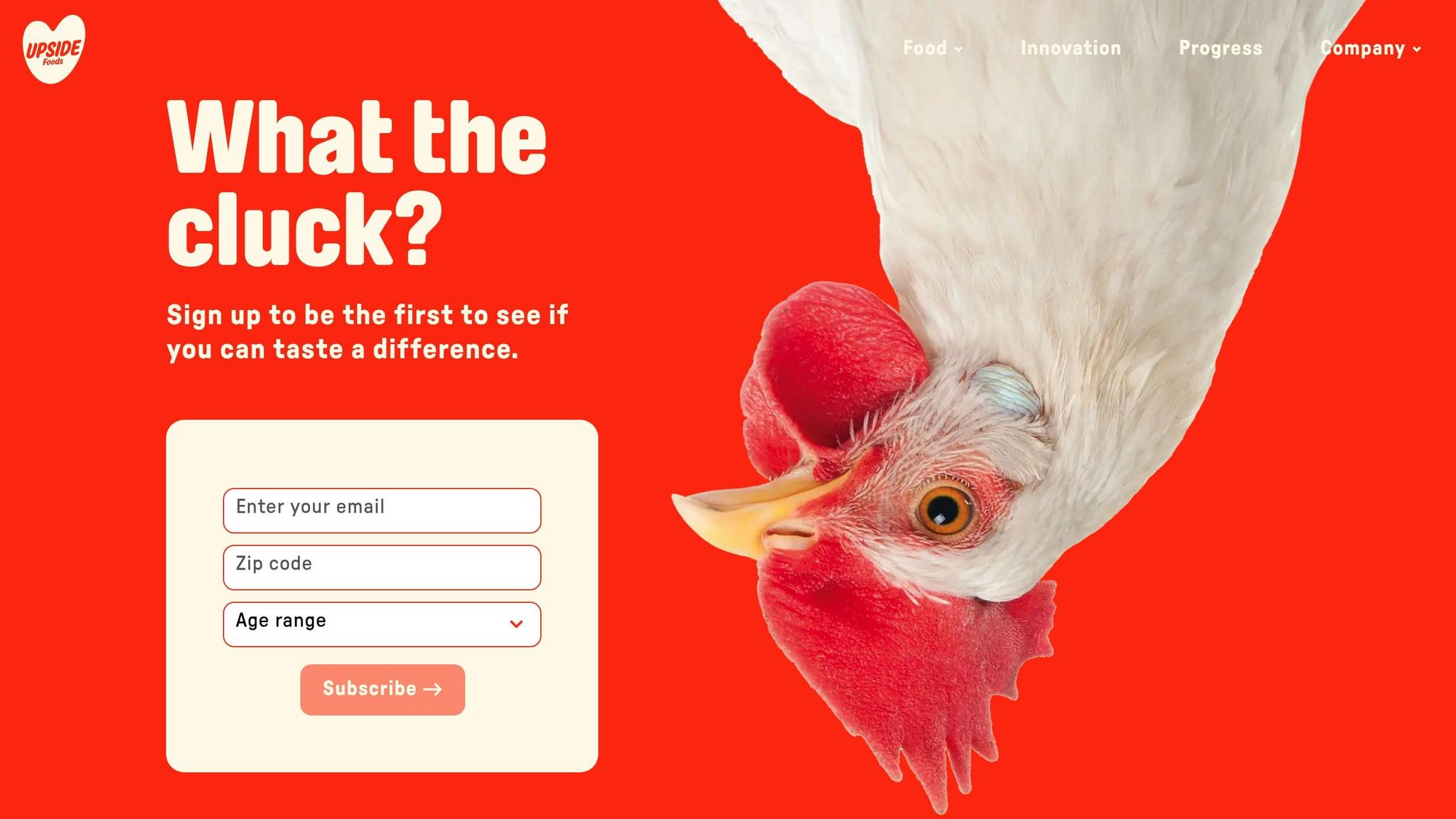

7. Upside Foods

Advancing Cultivated Meat Technology

Upside Foods has made a name for itself with its highly refined cultivation techniques. Their standout product, cultivated chicken fillets, is composed of over 99% cultivated chicken cells, with less than 1% consisting of binders like maltodextrin and transglutaminase [28]. Beyond chicken, they’ve also developed the world’s first cultivated beef meatballs and cultivated duck, demonstrating their ability to innovate across different types of meat [28].

In 2025, the company introduced "UPSIDE Chicken Essentials", a hybrid product combining cultivated chicken cells with plant-based ingredients. This approach addresses scalability issues while preserving the desired flavour and texture [29]. It reflects a growing industry trend towards hybrid products that balance technological advancements with commercial practicality.

Financial Milestones and Investment Support

Upside Foods has attracted significant financial backing to fuel its growth. In a landmark moment for the cultivated meat industry, the company raised £310 million in a Series C funding round, pushing its valuation past £775 million and making it the first unicorn in the sector [27][30]. To date, Upside Foods has raised a total of £471 million, enabling its shift from research and development to large-scale commercial production [27].

The funding round drew support from a diverse group of investors, including sovereign wealth funds like Temasek and Abu Dhabi Growth Fund, traditional meat giants such as Cargill and Tyson Foods, and prominent impact investors like Bill Gates and John Doerr [27][30]. Dr Uma Valeti, the company’s CEO and founder, remarked:

"UPSIDE has reached an historic inflection point, moving from R&D to commercialisation" [27].

This robust financial foundation has also been instrumental in achieving key regulatory milestones.

Regulatory Achievements and Market Focus

Upside Foods became a trailblazer in November 2022, receiving the first-ever FDA "no questions" letter, which confirmed the safety of its cultivated chicken [31][28]. This was followed by USDA label approval in June 2023 for its "cell-cultivated chicken" [31]. The company made its first commercial sale in July 2023 at Bar Crenn, a San Francisco restaurant led by three-star Michelin chef Dominique Crenn [11][29].

While regulatory approvals have been a major win, Upside Foods is also expanding its operations. The company remains focused on the U.S. market but faces challenges in states like Florida, Alabama, and Mississippi, where bans on cultivated meat were introduced in late 2024 [2]. Its EPIC facility in Emeryville, California, currently produces 22,680 kg of cultivated meat annually, with the potential to scale up to 181,440 kg per year [11].

Upside Foods’ progress exemplifies how cutting-edge technology, strategic investments, and regulatory achievements can come together to drive growth in the cultivated meat industry.

8. BlueNalu

Advancing Cultivated Meat Technology

BlueNalu is carving out a distinct niche in the cultivated meat industry by focusing on bluefin tuna toro, the highly sought-after fatty belly cut of the fish. Their process relies on proprietary biotechnology to grow fish cells in suspension, which are then developed into muscle and fat tissues. This approach ensures their product mimics the texture, flavour, and overall quality of premium seafood. Even better, it eliminates contaminants typically found in conventional seafood sources [32][33]. The company’s planned facility, equipped with 100,000-litre bioreactors, is designed to produce an impressive 2.7 million kilograms of seafood annually.

This innovative approach has garnered significant financial backing.

Funding and Investment Support

In January 2026, BlueNalu raised £8.5 million through a combination of convertible notes and preferred stock. This followed a £26 million Series B funding round aimed at expanding their pilot facility in San Diego. Agronomics, a key investor, increased its stake to 12.96% with a £5.1 million investment. Altogether, BlueNalu has raised over £91 million in disclosed funding, which includes a £46 million convertible note secured in 2020 and a £15.5 million Series A round in 2019. A techno-economic analysis has suggested that BlueNalu could achieve profit margins exceeding 70% once its large-scale facility becomes operational [33][35].

These investments are critical in driving the company’s ambitious growth plans.

Scaling Up and Market Entry

BlueNalu currently operates a pilot facility in San Diego, producing small batches of a few hundred pounds. However, the company is gearing up to build a 13,000-square-metre commercial plant in 2026. This facility will feature eight 100,000-litre bioreactors to support full-scale production. In April 2025, BlueNalu expanded its partnership with Nomad Foods to focus on premium foodservice and limited-time offerings in the UK and Europe. According to consumer research conducted in 2024, 92% of frequent sushi eaters in the UK expressed interest in trying BlueNalu’s cultivated bluefin tuna toro, with 74% willing to pay the same or more compared to conventional alternatives [32][34].

Regulatory Progress and Global Reach

In March 2025, BlueNalu became the only cultivated seafood company selected for the UK Food Standards Agency’s £1.6 million "Sandbox" programme. This two-year initiative is designed to accelerate safety assessments for innovative food products. CEO Lou Cooperhouse highlighted the product's appeal:

"Our cell-cultivated bluefin toro offers a new, high-quality seafood experience - nutrient-rich, free from environmental contaminants, and designed to complement a global supply chain that is increasingly fragile and unpredictable." [32]

Beyond the UK, BlueNalu has forged partnerships with leading seafood companies in Japan, South Korea, and Thailand, focusing on regions with high tuna consumption to maximise its market potential.

9. New Age Meats

Progress in Cultivated Meat Technology

New Age Meats is pushing the boundaries of cultivated meat by creating hybrid products that combine cultivated animal cells with plant-based ingredients. This approach improves texture, enhances flavour, and helps manage production costs. The company has also adopted serum-free media technology, eliminating the use of fetal bovine serum. This not only reduces production costs but also ensures the process remains entirely animal-free[14].

These technological strides are particularly important as the cultivated meat industry navigates a period of tighter funding, which has significantly influenced strategic decision-making across the sector.

Adjusting to Funding Challenges

The funding landscape for the cultivated meat industry has shifted dramatically, dropping from a high of about £790 million in 2021 to roughly £140 million in 2023[2]. In response, New Age Meats has reworked its fundraising strategy, focusing on proven methods that pave the way for commercial success. Investors are now leaning more towards partnerships within the traditional food industry rather than early-stage venture capital. This shift is pressuring companies to not only demonstrate technological progress but also provide clear and achievable timelines for bringing products to market[2].

10. Orbillion Bio

Advancing Cultivated Meat with a Premium Edge

Orbillion Bio is carving out a niche in the cultivated meat market by focusing on premium heritage meats like Wagyu beef, elk, and lamb. Unlike companies producing more common meats, Orbillion is dedicated to preserving the unique flavours and textures of these high-end options. The secret lies in their proprietary high-throughput screening platform, which quickly identifies the best cell lines for large-scale production. This approach ensures that the distinctive qualities of heritage meats remain intact, even as production scales up - a challenge many in the industry grapple with. This cutting-edge technology not only addresses taste preservation but also strengthens the company's position in attracting investor confidence.

Strategic Funding Approach

The fundraising landscape has been tough, with only £27 million raised across the sector in the first three quarters of 2025[36][37]. In response, Orbillion has adopted an asset-light, B2B strategy. This approach minimises capital expenditure while meeting the industry's growing demand for strict cost management and financial efficiency. It's a calculated move that aligns with the broader push for sustainable business models in the cultivated meat sector.

Scaling for the Future

Orbillion is fine-tuning its production methods to ensure scalability and cost efficiency. By shifting from pharmaceutical-grade to food-grade basal media, the company is significantly reducing production costs. Additionally, by working with innovation hubs and contract development and manufacturing organisations (CDMOs), Orbillion avoids the hefty expenses of building its own production facilities. This strategy not only lowers costs and risks but also positions the company to scale up more effectively in an increasingly competitive market[1][38].

How Investment is Shaping the Industry in 2025

As newer brands grow and evolve, funding patterns reveal a clear shift in focus within the industry. Investment in cultivated meat, once a booming sector, has seen a dramatic decline. After reaching nearly US$1 billion in 2021, funding plummeted to just US$36 million during the first three quarters of 2025, with median deal sizes at US$3.46 million. This sharp downturn has prompted a redirection of capital towards scalable production methods and regulatory advancements, forcing companies to streamline their operations and prioritise getting products to market [36][40][41].

The focus of investment is now on market readiness rather than early-stage research. Companies are channelling funds into areas like demonstration facilities, regulatory approvals, and cost-reduction technologies. For instance, in January 2026, German startup Innocent Meat secured €6 million (around US$7 million) from Genius Venture Capital to construct its first demonstration plant and tackle regulatory hurdles ahead of a planned market entry in 2028 [21]. A significant funding round was also allocated to regulatory submissions, highlighting this growing emphasis on preparing for market launch [1][40].

"Regional funding structures and financing instruments must be much better aligned with the needs and capabilities of young technology companies. Only then will it be possible for them to mobilise sufficient private capital."

– Uwe Bräuer, Managing Director, Genius Venture Capital [21]

This statement reflects the importance of alternative financing methods in a more cautious venture capital environment. Crowdfunding campaigns have gained traction, offering much-needed cash flow during lengthy regulatory processes and showcasing strong public support [1][40]. Additionally, sovereign wealth funds like Singapore’s Temasek and the Middle East’s DisruptAD are stepping in with long-term investments to support the development of commercial-scale facilities [40][1].

Investment is also driving innovation in hybrid products, which combine cultivated cells with plant-based proteins, as well as in enabling technologies. A notable example is Multus Biotechnology, which secured £7.9 million to establish the world’s first production facility for food-grade growth media in the UK. This advancement is a crucial step towards lowering production costs and making cultivated meat more accessible [1][39].

Conclusion

The journey of the top brands we've explored highlights not just technological and financial milestones but also the broader transformation of the food industry. These companies are laying the groundwork for a reimagined food system. From groundbreaking production methods to early commercial launches, they’re proving that cultivated meat is steadily moving from an ambitious concept to a tangible choice for consumers [37]. Their focus on regulatory frameworks, hybrid product strategies, and cost reduction is making this technology more accessible than ever.

The year 2025 stands out as a pivotal moment for the industry, marking the transition from initial research phases to market readiness. This shift is underscored by achievements like Mosa Meat raising over €1.5 million from retail investors in mere minutes - a clear reflection of public enthusiasm for this innovation [37][40]. These developments show how cultivated meat is evolving from a laboratory experiment into a viable food alternative.

As production scales and regulatory hurdles are addressed, the importance of consumer education cannot be overstated. Platforms such as Cultivated Meat Shop are playing a key role in preparing UK consumers for this shift. Through product previews, waitlist opportunities, and accessible educational content, they are helping bridge the gap between cutting-edge innovation and everyday adoption.

The potential impact is profound. By combining advanced production techniques with informed consumer engagement, the industry is paving the way for a food revolution that could cut land use and greenhouse gas emissions by over 90% compared to traditional beef [42]. This blend of innovation and awareness is setting the stage for cultivated meat to become an integral part of the UK’s food landscape.

FAQs

What challenges does the cultivated meat industry face in 2025?

The cultivated meat industry in 2025 is navigating some significant challenges: regulatory approval, production costs, and consumer acceptance.

Regulations are a tricky area, with approval processes differing across regions. This inconsistency can slow down the introduction of cultivated meat in certain markets, creating hurdles for global expansion. On top of that, production costs remain steep. While companies are working hard to cut expenses using new technologies and refining processes, affordability is still a major concern.

Then there's the question of consumer acceptance. For many, cultivated meat is still a novel concept, and misconceptions abound. Platforms like Cultivated Meat Shop are stepping up to bridge this gap by educating the public, dispelling myths, and fostering trust in this emerging food category. Tackling these challenges head-on is crucial if cultivated meat is to become a realistic, scalable alternative to traditional meat products.

How are companies like Mosa Meat and Meatable working to make cultivated meat as affordable as traditional meat?

Companies like Mosa Meat and Meatable are working hard to bring down the cost of producing cultivated meat, aiming to match or even undercut the price of traditional meat. A big part of this effort involves improving production technologies. Take highly efficient bioreactors, for example - these advanced systems have the potential to slash manufacturing costs by as much as 95% when compared to conventional biopharma equipment.

Another major focus is on reducing the cost of growth media, a crucial component for growing meat cells. By driving the cost down to as little as £0.22 per litre, these companies are making large-scale production far more feasible. With these breakthroughs, cultivated meat is steadily becoming a more practical and affordable option for consumers.

Why are regulatory approvals important for the growth of cultivated meat brands?

Regulatory approvals play a key role in the development of cultivated meat brands. They ensure these products comply with rigorous safety and quality standards established by regulatory bodies. This process is essential for earning consumer trust and legally introducing cultivated meat into global markets.

Several countries, including Singapore, the United States, and Israel, have already given the green light for the sale of cultivated meat, paving the way for others to follow suit. In the UK, the Food Standards Agency is actively working on regulations to facilitate the safe introduction of these products. These approvals do more than just clear legal hurdles - they also help position cultivated meat as a viable and forward-thinking alternative to traditional meat.