Cultivated meat is no longer a futuristic idea - it’s here. By late 2025, over 155 companies worldwide were producing meat grown from animal cells, with costs dropping by 99% since 2013. Regulatory approvals in the US, Singapore, and other countries have allowed companies like UPSIDE Foods and GOOD Meat to sell their products, while startups such as Ivy Farm and Vow are targeting niche markets or licensing new technologies.

Here’s what you need to know:

- Cost Progress: A cultivated burger cost £250,000 in 2013 but now costs £50–£100 per kilogram.

- Environmental Impact: Cultivated meat uses 64–90% less land and cuts air pollution by up to 94%.

- Regulatory Success: Seven companies have approval to sell cultivated meat, with others navigating complex processes.

- Funding Trends: The sector attracted £3.1 billion in private investment by 2024, but newer startups face tighter funding conditions.

This article dives into the key players - startups like Ivy Farm and Meatable, and leaders such as Aleph Farms and GOOD Meat - highlighting their strategies, challenges, and achievements in reshaping how we produce and consume meat.

‘A new era’: Lab-grown meat gets approval for sale in US

New Startups in Cultivated Meat

The cultivated meat industry is buzzing with startups introducing fresh ideas to revolutionise how meat is produced. From licensing cutting-edge biotechnology to focusing on niche markets, these companies are all working towards a common goal: making meat production more sustainable and efficient.

Here are some notable startups utilising unique strategies in the cultivated meat space:

Ivy Farm Technologies

Located in Oxford, Ivy Farm Technologies is leveraging biotechnology licensed from the University of Oxford to produce cultivated beef and pork mince. Their products are free from antibiotics and nitrates, offering a cleaner alternative to traditional meat. The process begins with a small cell sample, which is then grown in an optimised culture system, eventually transforming into lean mince suitable for burgers, meatballs, and sausages.

Ivy Farm operates on a three-tier revenue model: licensing its biotechnology, supplying raw ingredients, and planning to launch its own consumer brand. Additionally, the company has patents pending in 12 countries, showcasing its commitment to advancing cultivated meat technology.

Meatable

The Dutch startup Meatable has created proprietary technology that mimics the natural growth of fat and muscle cells from a single animal sample. While their primary focus has been on cultivated pork and beef, their technology also has the potential to produce chicken, sheep, and fish. This method promises a quicker and more efficient production cycle compared to traditional farming, while delivering meat that's molecularly identical to conventionally produced counterparts.

Meatable secured £48 million in funding, including a £38 million Series A round, and was celebrated as one of TIME's Best Inventions of 2024. The company also earned a spot on Europe's Top 50 Growth Companies in the 2025 Tech Tour Growth50 List. However, despite its achievements and funding, Meatable faced financial challenges and announced liquidation in early 2026.

Vow

Australian startup Vow takes a different approach by focusing on cultivated exotic meats tailored to niche markets. Their strategy highlights the diversity within the industry, catering to specific culinary preferences while tackling sustainability issues. By exploring less conventional options, Vow demonstrates how cultivated meat can address both environmental concerns and consumer curiosity.

These startups illustrate that innovation in cultivated meat goes beyond simply scaling up production of traditional proteins. Whether through licensing technology, developing novel production methods, or targeting specialised markets, these companies are exploring diverse strategies to achieve commercial success in this evolving industry.

Established Companies in Cultivated Meat

While startups often drive fresh ideas, established companies in the cultivated meat industry have laid the groundwork by tackling regulatory challenges and scaling production. These trailblazers have achieved major milestones like securing approvals, building large-scale facilities, and bringing cultivated meat to market. Let’s take a closer look at some key players and their achievements.

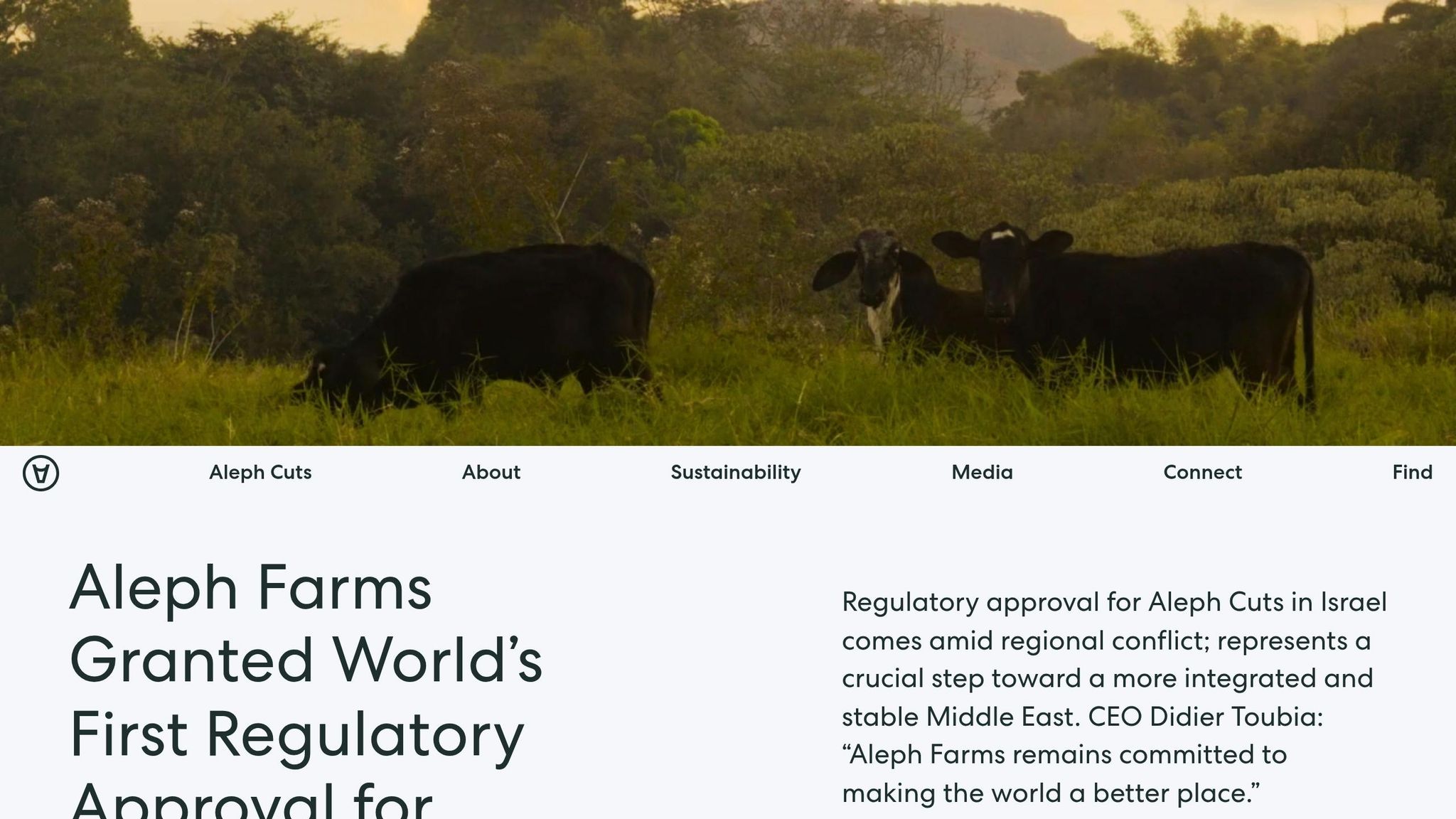

Aleph Farms

Aleph Farms, an Israeli company, made history in January 2024 by receiving the world’s first regulatory approval for cultivated beef from the Israeli Ministry of Health. Their flagship product, Aleph Cuts, consists of cultivated beef steaks grown using bioreactor technology, setting them apart from companies focusing solely on ground meat. Following a "wholly cow" philosophy, Aleph Farms also produces collagen-based products. In February 2022, they opened a 3,000 m² pilot plant in Rehovot, preparing for a commercial launch in Israel [5].

Upside Foods

Previously known as Memphis Meats, Upside Foods became the first company in the United States to gain full regulatory approval from the FDA and USDA for cultivated chicken in June 2023. Their product debuted at Bar Crenn in San Francisco, earning widespread praise. Upside Foods operates a 6,500 m² facility in California, capable of producing up to 23 tonnes of meat annually, with plans to expand to around 181 tonnes [6][7]. The company has also ventured into cultivated seafood by acquiring Cultured Decadence [7].

Mosa Meat

Based in the Netherlands, Mosa Meat introduced the world to the first cultivated burger in 2013. Since then, they’ve focused on making cultivated beef more affordable and scalable, with production costs currently estimated between £50–100 per kilogram for small-scale production [1]. In January 2025, Mosa Meat became the first to submit an application for cultivated fat to the European Food Safety Authority (EFSA), initiating an 18-month risk assessment process [5]. The company is also collaborating with the UK Food Standards Agency’s £1.6 million regulatory sandbox, launched in June 2025, which includes monthly workshops to establish safety and hygiene standards for the UK market [3].

GOOD Meat (Eat Just)

A division of Eat Just, GOOD Meat has been a pioneer since obtaining the first regulatory approval for cultivated meat in Singapore in December 2020. They achieved another milestone in May 2024 by becoming the first company to sell cultivated meat in a retail setting at Huber’s Butchery in Singapore. In June 2023, they secured US approval, launching their product at José Andrés’ China Chilcano in Washington, D.C., the following month [6][5][8]. GOOD Meat produces cultivated chicken in various formats, such as nuggets and satays, and has developed hybrid products that combine cultivated cells with plant-based ingredients to improve texture and lower costs.

sbb-itb-c323ed3

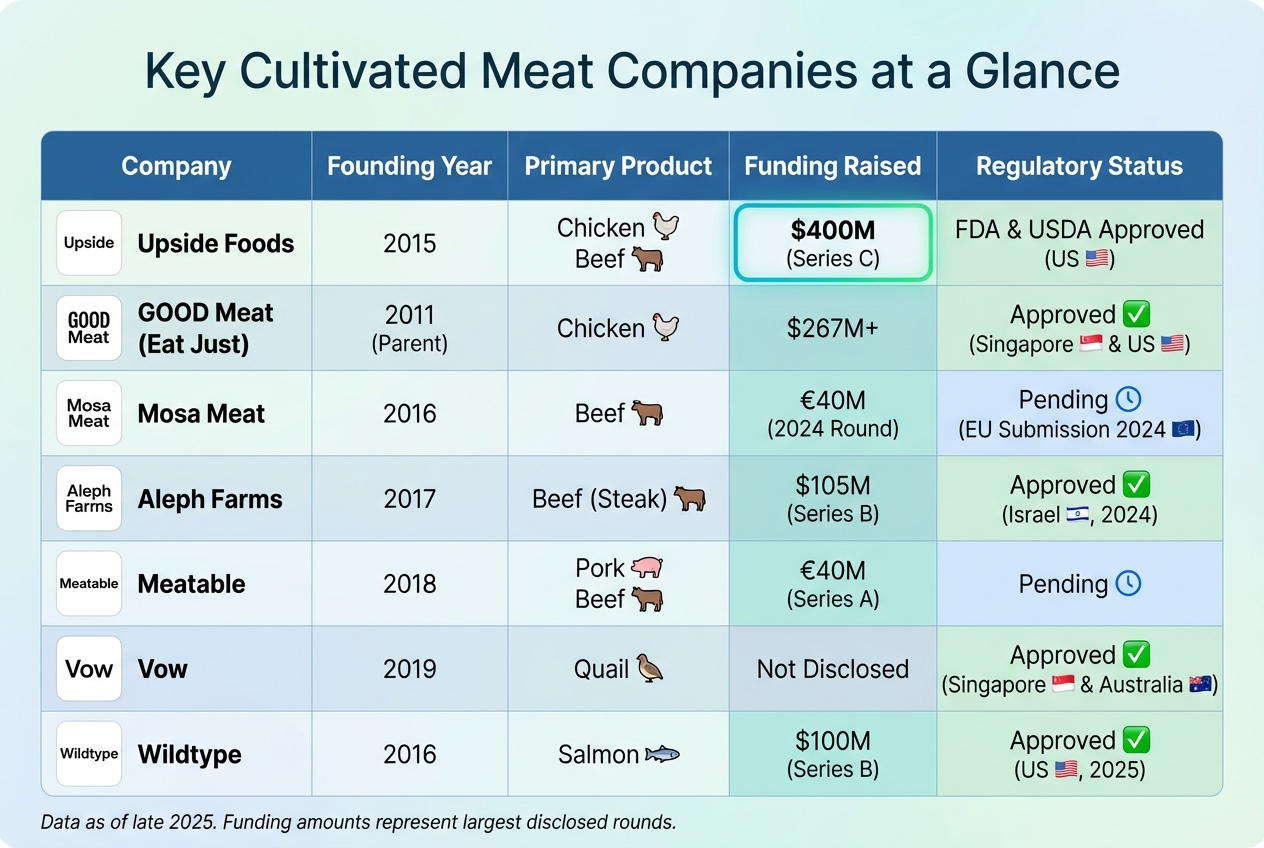

Comparison of Key Companies

Cultivated Meat Companies Comparison: Funding, Products and Regulatory Status

The cultivated meat industry is a mix of trailblazers and emerging players, each taking unique approaches to development, funding, and regulatory challenges. Established companies have managed to secure substantial investments – for instance, Upside Foods raised a staggering $400 million. In contrast, newer entrants are navigating a much tighter funding landscape, with the largest deals in 2024 only reaching between £40–55 million, far from the sector's historical top 10 funding rounds [4]. As Alex Frederick, Senior Emerging Technology Analyst at PitchBook, explained:

VCs have largely made this shift from growth to profitability, and that's wreaked havoc on this industry [11].

This shift in investment priorities underscores the current challenges and opportunities within the sector. To better understand these dynamics, we can break down the differences between companies in terms of funding, product strategy, and regulatory progress.

When it comes to product strategies, companies are clearly targeting different niches. Aleph Farms is focusing on premium structured beef products, such as thin-cut steaks, while Meatable has opted for pork-based items like sausages and dumplings, emphasising rapid production cycles [9][5][10]. Vow, on the other hand, is exploring less conventional species, adding diversity to the market [5]. These varied approaches highlight the industry's active experimentation with niche markets.

Regulatory progress is another area where companies differ significantly. By late 2025, seven companies had achieved regulatory clearance: Upside Foods, GOOD Meat, Vow, Wildtype, Mission Barns, Believer Meats, and PARIMA [2]. Meanwhile, most startups are still navigating the lengthy and complex approval processes required to bring their products to market.

Key Milestones Table

The table below provides a snapshot of key milestones, offering a clearer picture of how these companies compare.

| Company | Founding Year | Primary Product | Funding Raised | Regulatory Status |

|---|---|---|---|---|

| Upside Foods | 2015 | Chicken, Beef | $400M (Series C) [12] | FDA & USDA Approved (US) [11] |

| GOOD Meat (Eat Just) | 2011 (Parent) | Chicken | $267M+ [13] | Approved (Singapore & US) [11] |

| Mosa Meat | 2016 | Beef | €40M (2024 Round) [4] | Pending (EU Submission 2024) [4] |

| Aleph Farms | 2017 | Beef (Steak) | $105M (Series B) [13] | Approved (Israel, 2024) [14][5] |

| Meatable | 2018 | Pork, Beef | €40M (Series A) [13] | Pending |

| Vow | 2019 | Quail | Not Disclosed | Approved (Singapore & Australia) [4][14][5] |

| Wildtype | 2016 | Salmon | $100M (Series B) [12] | Approved (US, 2025) [1][2] |

These comparisons illustrate the rapid evolution and diverse strategies shaping the cultivated meat industry. Each company’s approach, whether through funding, product focus, or regulatory achievements, reflects the dynamic and competitive nature of this growing sector.

The Role of Cultivated Meat Shop

As cultivated meat edges closer to becoming a regular part of our diets, consumers are in need of straightforward, reliable information. That’s where Cultivated Meat Shop steps in - it’s the first platform designed specifically for consumers curious about this new food category.

The site provides easy-to-understand guides, product timelines, and side-by-side comparisons of cultivated and conventional meat. This helps consumers make informed decisions and keeps them engaged with the latest developments in this space.

One of the standout features of Cultivated Meat Shop is its waitlist, which ensures that users stay updated on progress as regulatory approvals move forward. As Professor Robin May, Chief Scientific Advisor at the Food Standards Agency (FSA), explains:

Our aim is to ultimately provide consumers with a wider choice of new food, while maintaining the highest safety standards [15].

Beyond updates, the platform aims to connect consumers directly with cultivated meat products once they become widely available. It serves as a bridge, bringing lab-grown innovations closer to everyday kitchens.

Another key focus of the platform is tracking the industry's movement toward achieving price parity with traditional meat. By offering transparency on this journey, Cultivated Meat Shop helps consumers better understand the technology and fosters trust in cultivated meat as a safe and practical alternative to conventional options.

Conclusion

The cultivated meat industry is making strides, driven by both emerging startups and established players. Recent regulatory advancements highlight the speed of its growth. For example, Vow has scaled up production using bioreactors as large as 15,000 litres, showcasing the capability for industrial-level manufacturing[4].

Collaborative efforts are adding fuel to this momentum. In the UK, regulatory bodies are expediting safety approvals, which strengthens the industry's reputation and trustworthiness.

Educating consumers is another crucial piece of the puzzle. As cultivated meat transitions from a niche concept to a mainstream choice, platforms like Cultivated Meat Shop are stepping up to inform the public about the benefits and potential of this technology. Transparent and accessible information helps build trust, paving the way for wider acceptance.

The numbers tell a compelling story too. Production costs have plummeted by over 99% since 2013, and experts predict price parity with conventional meat by 2030–2035[1]. With innovation and scaling working hand in hand, cultivated meat is poised to transform the way we think about and consume meat in the years to come.

FAQs

What makes cultivated meat more environmentally friendly than traditional meat?

Cultivated meat offers a far gentler impact on the planet compared to traditional livestock farming. Research highlights its potential to slash greenhouse gas emissions by 78–96%, use 82–96% less water, and require about 99% less land. Beyond these figures, it also eases other environmental stresses, including acidification and the release of particulate matter, while significantly reducing the need for agricultural land.

The benefits don’t stop there. When production facilities run on renewable energy, the carbon footprint can shrink by an additional 70% compared to using conventional energy sources. Although current production methods can be energy-heavy, refining these processes and shifting to cleaner energy sources could position cultivated meat as a much more sustainable alternative to conventional meat.

How are companies like Ivy Farm and Vow standing out in the cultivated meat industry?

Ivy Farm places a strong emphasis on health-focused, science-driven products, all grounded in research from the UK. Leveraging cutting-edge biotechnology developed at the University of Oxford, they produce cultivated mince products like Angus beef burgers and Wagyu meatballs. These products are packed with protein, low in saturated fat, and completely free from antibiotics. Ivy Farm also prioritises openness, giving consumers a clear view of their sustainable production methods, which use advanced bioreactor technology.

Vow takes a different path, focusing on crafting entirely new meat varieties that don’t exist in traditional markets. Their creations, such as cultured Japanese quail, are tailored for premium dining and adventurous palates. By prioritising flavour, creativity, and collaborations with high-end restaurants, Vow is carving out a niche as a pioneer in the cultivated meat industry.

These contrasting approaches underline the variety within the field: Ivy Farm leans into nutrition and local expertise, while Vow explores uncharted culinary territory with a focus on exclusivity and innovation.

What challenges do companies face in getting cultivated meat approved in the UK?

Navigating the path to bring cultivated meat to UK markets means dealing with rigorous regulatory standards set by the Food Standards Agency (FSA) and Food Standards Scotland (FSS). These regulations are in place to ensure that novel foods, like cultivated meat, meet strict safety and compliance requirements. Companies must present comprehensive evidence covering every step of their production process, from the origin of the cells to the finished product.

Here are some of the main challenges businesses face:

- Extensive safety data: Companies need to provide in-depth details about cell lines, nutrient media, any residual substances, and microbiological safety.

- Production method approval: Since cultivated meat involves cutting-edge processes, firms must gain approval for their specific production methods, which are still relatively uncharted territory under UK law.

- Labelling and traceability: Businesses must adhere to evolving standards for product labelling while ensuring compliance with both UK and international regulations.

To assist with this, the FSA has launched initiatives like a two-year regulatory sandbox programme, designed to help businesses prepare their applications. Even so, the process remains intricate, and the time it takes to gain approval can vary. Overcoming these regulatory hurdles is a critical step for cultivated meat to make its way to UK consumers.