Cultivated seafood is reshaping how fish is produced, offering a cleaner and more controlled alternative to traditional fishing and aquaculture. By growing real fish meat from cells in bioreactors, it eliminates the need for fishing or farming, tackling issues like overfishing, pollution, and habitat destruction. Startups are now advancing from lab research to commercial production, targeting high-value species like bluefin tuna and grouper. With regulatory approvals progressing, these products may soon be available in restaurants.

Key Points:

- Problem: 90% of global fish stocks are overfished or fully exploited, threatening a £300 billion market.

- Solution: Cultivated seafood grows fish meat from cells, avoiding pollutants, antibiotics, and ecosystem damage.

- Progress: Companies like Wanda Fish and BlueNalu are scaling production, focusing on premium fish like tuna and grouper.

- Market Readiness: Startups are targeting high-end restaurants, with regulatory applications expected in 2025.

Quick Snapshot:

- Wanda Fish: Cultivated bluefin tuna, £5.3m funding, targeting Israel, US, and Asia.

- BlueNalu: Bluefin tuna, £83.6m funding, restaurant-focused, pursuing US and Singapore approval.

- UMAMI Bioworks: Grouper, snapper, and eel; expanding production in Singapore and the UK.

- Atlantic Fish Co.: Whitefish fillets, £1.84m raised, US-focused.

- Bluu Seafood: Hybrid fish products, targeting Europe, US, and Singapore.

Cultivated seafood is gaining traction as a safer, scalable way to meet global seafood demand while protecting marine ecosystems. Startups are positioning their products for launch by 2026, focusing on restaurant distribution to refine quality and build consumer trust.

Umami's Cultivated Fish: A Collaborative Approach to Fresh and Sustainable Seafood

Leading Cultivated Seafood Startups

Cultivated seafood is moving swiftly from research labs to dinner tables, thanks to the efforts of leading startups. These companies are not only advancing production technologies but are also navigating regulatory approvals and preparing for commercialisation. Here's a closer look at some of the key players shaping this emerging industry.

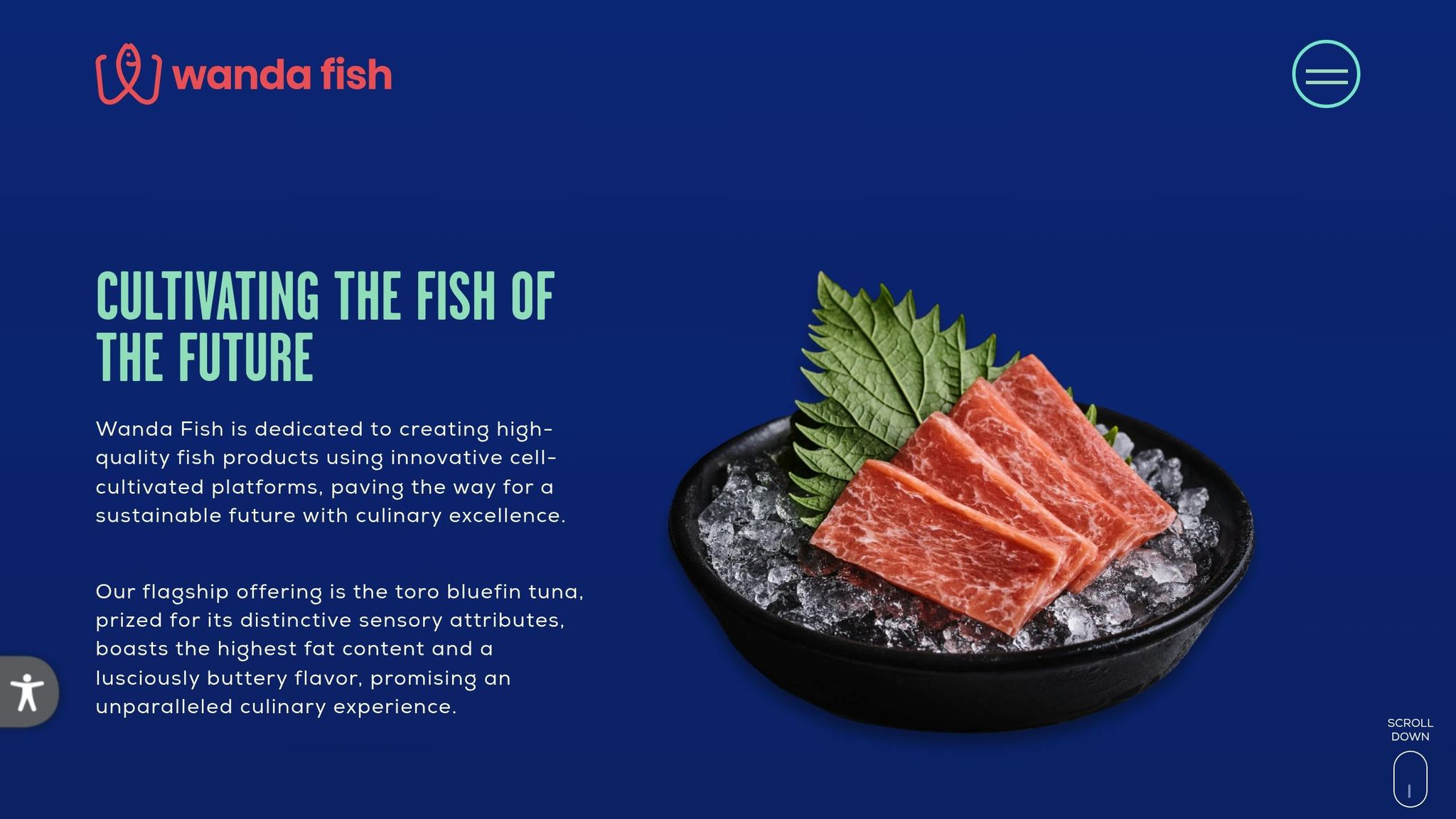

Wanda Fish – Cultivated Bluefin Tuna

Wanda Fish, an Israeli company, is making waves with its cultivated bluefin tuna toro sashimi. This flagship product mimics the marbling and nutritional profile of wild bluefin tuna, offering protein and omega-3 fatty acids. In October 2023, Wanda Fish raised £5.2 million in seed funding and opened Europe’s first pilot plant in Hamburg. The company is eyeing regulatory applications in 2025, with plans to target premium markets in Israel, the United States, and Asia - regions where bluefin tuna is highly sought after but heavily overfished [1].

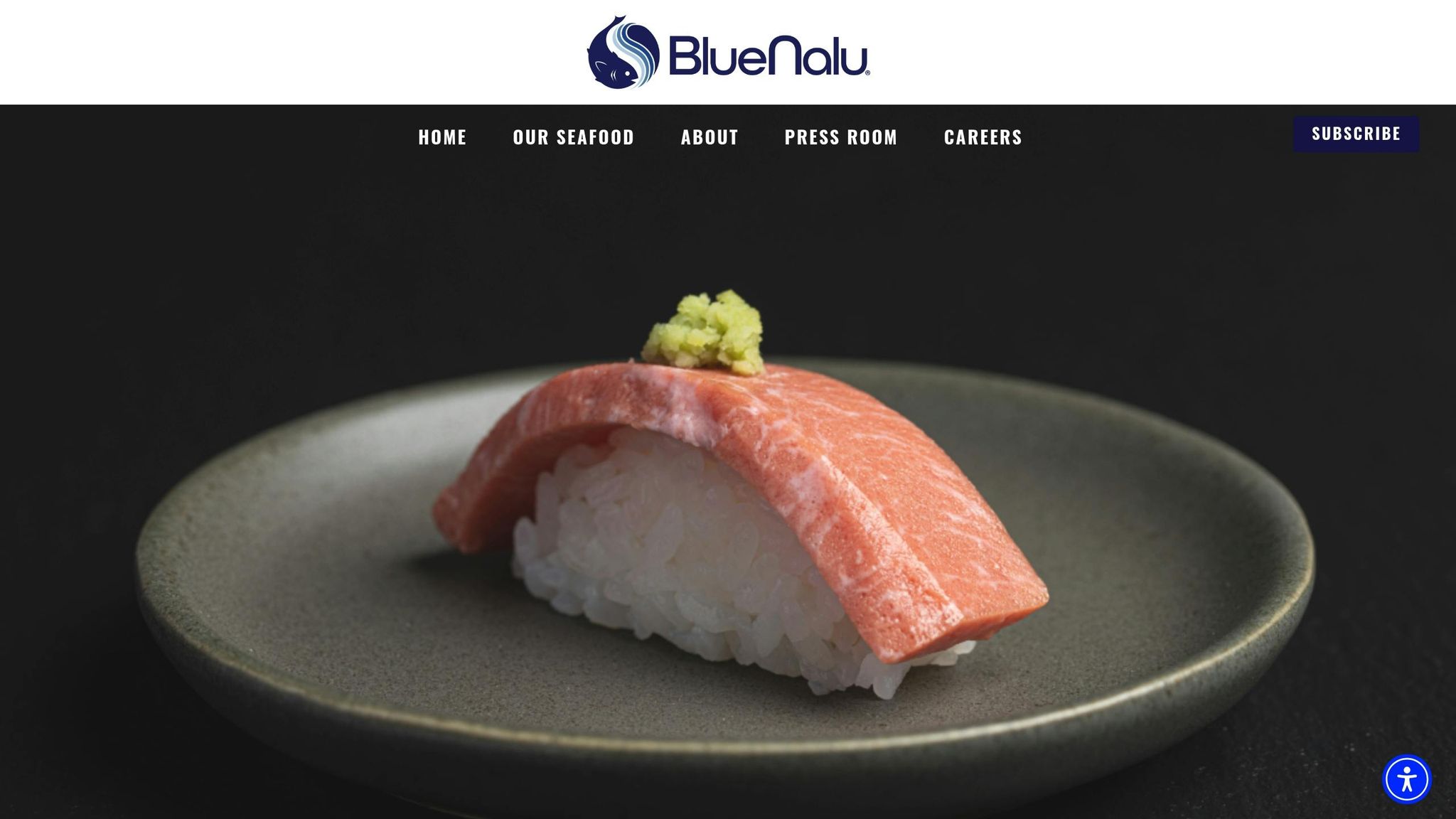

BlueNalu – Scaling Cultivated Seafood for Restaurants

BlueNalu has taken a unique approach by focusing on restaurants instead of direct retail. By launching its cultivated seafood in select dining establishments, the company aims to showcase quality and gather valuable feedback from chefs and diners. BlueNalu has applied for FDA approval for its cultivated bluefin tuna and is pursuing regulatory clearances in several regions, with Singapore as a priority market.

Lou Cooperhouse, co-founder, president, and CEO of BlueNalu, commented that the company is committed to scaling production and securing regulatory approvals in the US, Singapore, and other countries before introducing its products to the market [1].

Atlantic Fish Co – Restaurant-Quality Whitefish

Based in North Carolina, Atlantic Fish Co is developing cultivated black sea bass and whitefish fillets with a focus on restaurant-grade quality. Using bioreactors to grow healthy fish cells, the startup has secured £900,000 in seed funding, including a £230,000 NSF Small Business Innovation Research grant and support from the US Department of Agriculture. To test its product’s appeal, the company hosted a tasting event at the North Carolina Food Innovation Lab, where chefs and industry experts evaluated the texture, flavour, and culinary potential of its cultivated whitefish [2][3][5].

UMAMI Bioworks – Cultivated Grouper and Snapper

Singapore’s UMAMI Bioworks is concentrating on high-value seafood species popular in Asian cuisine. After receiving positive feedback at tasting events, the company announced a significant 30-fold production capacity expansion in March 2024. UMAMI Bioworks is cultivating grouper, snapper, and eel - species under threat from overfishing. The company has also partnered with others to build GMP-compliant facilities for scalable production. Recently, UMAMI Bioworks expanded into the United Kingdom, marking its first European operations and signalling its intent to tackle multiple regulatory markets simultaneously [1][4].

Bluu Seafood – Hybrid Cultivated Fish Products

Bluu Seafood, a German company, is taking a hybrid approach by combining cultivated fish cells with plant-based ingredients. This method retains the authentic taste and nutritional benefits of fish while creating products like fish balls and fish fingers. In June 2024, Bluu Seafood secured €16 million (around £13.6 million) in Series A funding to scale production and pursue regulatory approvals. The company has already applied for authorisation in Singapore and the United States, aiming for a multi-market launch [1][3][4].

Market Readiness and Regulations

Cultivated seafood is on the brink of a major breakthrough: transitioning from pilot projects to dining tables. Several startups are gearing up to submit formal regulatory applications and aim to launch their products in the next year or two. However, the regulatory landscape varies significantly across regions, presenting both opportunities and hurdles.

Regulatory Progress Worldwide

Singapore has taken the lead in approving cultivated seafood. Companies like BlueNalu and Bluu Seafood have prioritised this market, with Bluu Seafood already submitting applications for authorisation. Singapore’s forward-thinking regulatory system, its reputation as a global food hub, and its challenges in seafood supply make it an attractive launchpad. Success here could set a benchmark for other countries.

In the United States, the regulatory race is heating up. Atlantic Fish Co. and BlueNalu, supported by non-dilutive funding such as a £230,000 NSF grant, are actively working with the US Food and Drug Administration. BlueNalu has even applied for FDA approval for its cultivated bluefin tuna, showing that multiple players are advancing through the American regulatory process.

Europe is progressing at a slower but steady pace. Bluu Seafood’s 2,000-square-metre pilot plant in Hamburg, which opened in 2024, is Europe’s first facility dedicated to cultivated fish production. The company has also submitted applications in Singapore and the USA [1][4]. Meanwhile, UMAMI Bioworks has expanded into the United Kingdom, marking its first European operation and signalling plans to navigate multiple regulatory markets at once [4].

Wanda Fish is adopting a global strategy, planning regulatory applications across Israel, the United States, and Asia by 2025 [1]. This staggered approach reflects the complexities of varying regulations but also highlights growing confidence that approvals can be secured within comparable timelines.

The regulatory process involves several steps. Startups must first ensure their products meet the quality of wild-caught fish. For instance, Atlantic Fish Co. is collaborating with chefs and foodservice providers in pilot tastings to validate product quality before submitting for approval [2]. These tastings not only fine-tune the product but also demonstrate its readiness to regulators.

Why Seafood May Reach Market First

Several factors give cultivated seafood an edge for quicker market entry. One of the most pressing is the global fisheries crisis, which has created an urgent demand for sustainable alternatives. This urgency incentivises regulators, particularly in regions reliant on seafood imports, to fast-track approvals.

From a technical perspective, fish cells are simpler to replicate than mammalian muscle tissue. This simplicity allows companies like Bluu Seafood to use hybrid methods, combining cultivated fish cells with plant-based ingredients. Such approaches reduce costs, especially compared to producing whole fillets [1].

The challenges in the £300 billion global seafood market further strengthen the case for cultivated seafood [2]. Consumer acceptance is also likely to be higher, given the environmental benefits of reducing overfishing. Companies like BlueNalu are strategically introducing their products through restaurants and foodservice channels, allowing for a controlled rollout that could ease the path to wider market adoption.

With several startups aligning their regulatory efforts, cultivated seafood could hit early-adopting markets like Singapore within the next 12 to 24 months.

sbb-itb-c323ed3

Startup Comparison

The cultivated seafood industry is buzzing with startups at various stages of progress, each focusing on specific species and markets. Here’s a detailed look at how these companies stack up against each other.

Comparison Table

| Startup | Target Species | Product Status | Funding Raised | Regulatory Timeline | Target Markets | Key Differentiator |

|---|---|---|---|---|---|---|

| Wanda Fish | Bluefin tuna | First product unveiled (toro sashimi) | £5.3 million | 2025 regulatory applications planned | Israel, U.S., Asia | Premium sashimi-grade with marbling similar to wild tuna |

| Atlantic Fish Co. | Black sea bass (whitefish) | Development stage | £1.84 million total | FDA pre-market consultation underway | U.S. | Cost-effective approach, restaurant-grade fillets |

| BlueNalu | Bluefin tuna | Filed for FDA approval | £83.6 million | U.S. and Singapore approval sought | Singapore, U.S., others | Strong funding for scaling restaurant distribution |

| UMAMI Bioworks | Grouper, snapper, eel | Capacity expansion phase | Not disclosed | Not specified | Singapore, UK | Multi-species production with 30x capacity expansion |

| Bluu Seafood | Atlantic salmon, rainbow trout | Hybrid products developed | Not disclosed | Applications submitted in Singapore and the U.S. | Germany, Europe | Europe's first pilot plant, hybrid cultivated-plant approach |

When it comes to funding, the landscape varies significantly. BlueNalu leads the pack with £83.6 million raised, giving it a strong financial base for scaling operations [7]. Meanwhile, Atlantic Fish Co. has raised £1.84 million, supplemented by over £560,000 in non-dilutive grants from the U.S. National Science Foundation and the U.S. Department of Agriculture [2][6]. Wanda Fish, after securing £5.3 million in seed funding in October 2023, is gearing up for a Series A round to expand its manufacturing capabilities [1].

Most companies are aiming for market entry between 2025 and 2026. For instance, Wanda Fish plans to submit regulatory applications in 2025 across Israel, the U.S., and Asia [1], while Atlantic Fish Co. is working on finalising its product and regulatory approvals for a U.S. launch [2].

The choice of species reflects varying strategies. Premium fish like bluefin tuna, targeted by Wanda Fish and BlueNalu, cater to high-end markets and address overfishing concerns. On the other hand, Atlantic Fish Co. is focusing on high-value whitefish, ideal for versatile restaurant dishes. Meanwhile, UMAMI Bioworks is diversifying with multiple species, reducing risk and appealing to a broader range of consumer tastes.

Manufacturing capabilities also differ significantly. Bluu Seafood operates Europe’s first cultivated fish pilot plant in Hamburg, a facility spanning 1,858 square metres equipped with fermenters to grow muscle, fat, and connective tissue cells across multiple species [1]. Similarly, UMAMI Bioworks has announced a 30-fold capacity expansion in Singapore, driven by positive feedback from tasting events [1].

Strategic collaborations are playing a critical role in refining products and scaling operations. For example, UMAMI Bioworks has partnered with KCell Biosciences for cell culture media and WSG for bioprocessing hardware, with plans to co-invest in a GMP-compliant hub facility [4]. Atlantic Fish Co. is teaming up with chefs and foodservice operators to test its products before regulatory submission [2].

For most startups, the initial focus is on restaurants and foodservice channels rather than retail supermarkets. This approach allows for premium positioning and direct feedback from chefs, which is invaluable for refining products. BlueNalu, for instance, is scaling specifically for restaurant distribution, while Atlantic Fish Co. is working closely with chefs to perfect its restaurant-grade fillets [1][2]. Bluu Seafood is taking a unique route with hybrid products that combine cultivated fish cells with plant-based ingredients, collaborating with spice manufacturer Van Hees [3].

On the regulatory front, BlueNalu has already applied for FDA approval for its cultivated bluefin tuna, while Bluu Seafood has submitted applications in both Singapore and the U.S. [1][4]. Wanda Fish is pursuing a global strategy, with plans to file regulatory applications in Israel, the U.S., and Asia by 2025 [1]. Meanwhile, UMAMI Bioworks is expanding into the UK, marking its first European operation and signalling an intent to navigate multiple regulatory landscapes [4].

Finally, Atlantic Fish Co. has gained attention from impact-focused investors like Norway’s Katapult Ocean for its efficient use of funds [2]. Each of these startups brings something distinct to the table, shaping the future of cultivated seafood in their own way.

The Future of Cultivated Seafood

The cultivated seafood sector is emerging as a promising solution to some of the most urgent challenges in global food systems. With the £400 billion seafood market facing a severe supply crisis that traditional aquaculture cannot resolve, cultivated seafood offers a practical alternative. By producing a variety of fish species without depleting wild stocks or damaging marine ecosystems, it provides a sustainable path forward. This pressing need has driven substantial investment and regulatory advancements in the industry.

What sets cultivated seafood apart is its focus on efficiency and strategy. While cultivated meat has struggled with high costs and limited market reach, seafood companies have adhered to clear milestones and practical approaches [2][3]. For instance, in 2024, Wildtype achieved a significant breakthrough by securing regulatory approval from the United States Food and Drug Administration to sell cultivated salmon. These products are now being served in select restaurants across several states [3]. Such regulatory progress highlights the shift from lab-based development to real-world applications.

Several companies are preparing for market entry in the near future, with regulatory applications already in progress in regions like Singapore, the United States, Israel, and Europe [1]. This rapid progress underscores the industry's readiness to scale and meet market demands.

For consumers, cultivated seafood presents clear benefits in terms of sustainability and food safety. Initially, these products will target high-end restaurants and foodservice providers, allowing companies to position themselves as premium brands while gathering valuable feedback. Collaboration with chefs and culinary experts will help refine these offerings. Early adopters in markets such as Singapore, the United States, and Europe will soon have the chance to experience these innovations firsthand.

Strategic partnerships are also playing a key role in overcoming technical challenges. By combining expertise in areas like cell line development, growth media optimisation, and bioprocessing technologies, companies are accelerating progress [4].

The cultivated seafood industry is well-positioned to make a significant impact within the alternative protein space [2][3]. Unlike cultivated meat, which faces hurdles in replicating complex textures, seafood products such as fillets and sashimi generally require less intricate processing. Combined with the critical supply issues in global fisheries, these factors create strong market demand and regulatory momentum. As production scales and costs decline, cultivated seafood has the potential to move beyond its premium niche and become accessible to everyday consumers.

Platforms like Cultivated Meat Shop provide valuable resources and updates on the availability of these products. While cultivated seafood isn't yet widely available, progress behind the scenes suggests that by 2026–2027, consumers in key regions will have meaningful opportunities to choose these products alongside traditional seafood. This expansion could help address pressing sustainability and food security concerns while offering more choices to consumers.

FAQs

What makes cultivated seafood more environmentally friendly compared to traditional fishing and aquaculture?

Cultivated seafood presents a promising way to enjoy seafood while treading more lightly on the planet. Unlike traditional fishing and large-scale aquaculture, it sidesteps the issues of overfishing, helping to safeguard marine ecosystems and protect vulnerable species from depletion. It also avoids the pollution and habitat damage often tied to conventional fish farming.

By producing seafood directly from cells, this method significantly cuts greenhouse gas emissions and uses far less water and land. It offers a cleaner and more responsible way to savour seafood, aligning taste with care for the environment.

What challenges do startups face in bringing cultivated seafood to market, and how are they overcoming them?

Startups venturing into cultivated seafood face some tough challenges as they work to get their products into the hands of consumers. One of the biggest obstacles is the steep production cost. Growing seafood from cells involves cutting-edge technology and demands a hefty financial investment. To tackle this, many companies are scaling up their production methods, finding ways to streamline processes, and teaming up with research institutions to bring costs down.

Another significant hurdle is regulatory approval. Since cultivated seafood is a relatively new concept, it must meet strict safety and labelling requirements. Startups are actively engaging with regulatory agencies to ensure they meet these standards, while also aiming to build trust among consumers. Speaking of consumers, public awareness and acceptance are equally important. To address this, companies are focusing on educating people about the potential upsides of cultivated seafood, including its role in sustainability, its ability to reduce ecological damage, and how it could help combat overfishing.

These combined efforts are setting the stage for a future where cultivated seafood could become an accessible and sustainable alternative to traditional seafood.

Why are high-end restaurants the first to offer cultivated seafood, and how will this impact its future availability for consumers?

High-end restaurants are often the first to embrace cultivated seafood, as they provide the perfect environment to introduce premium, forward-thinking products. These venues allow chefs to craft exceptional dining experiences, highlighting the distinct taste and texture of cultivated seafood while also presenting its environmental advantages. The diners at these establishments, often eager to explore new culinary ideas, become the ideal audience for such innovations.

This strategy not only raises awareness but also builds confidence in cultivated seafood. At the same time, it offers an opportunity to fine-tune production methods and prepare for larger-scale distribution. As production becomes more efficient and costs decline, cultivated seafood is expected to transition beyond fine dining, eventually making its way to supermarket shelves and becoming a regular option for everyday consumers.